Melbourne Fund Manager Boman Group Captures National Attention with Bold Vision and Steady Growth

In Australia’s capital markets, Boman Group is rapidly emerging as a standout presence, thanks to its determined strides and distinctive vision.

Founded in 2011, this Melbourne fund manager has successfully managed over AUD 650 million in assets. Recently, Boman Group has entered a new phase of growth, drawing the attention of The Australian Financial Review, one of Australia’s leading financial publications.

Australian Financial Review

Boman Group, formerly known as BMYG Financial Group, has recently completed a comprehensive rebranding initiative. As part of this transformation, the Melbourne fund manager has introduced a seasoned Advisory Board and launched two major new business divisions: a Joint Family Office and a Capital Markets Advisory service.

In addition to these new developments, Boman Group is also enhancing its existing flagship strategy—the Boman Paradigm Fund. The firm is preparing to launch the third phase of this strategy, injecting renewed energy into Australia’s and the global venture capital and private equity markets.

Australian Financial Review

Boman Group Launches Two New Business Divisions

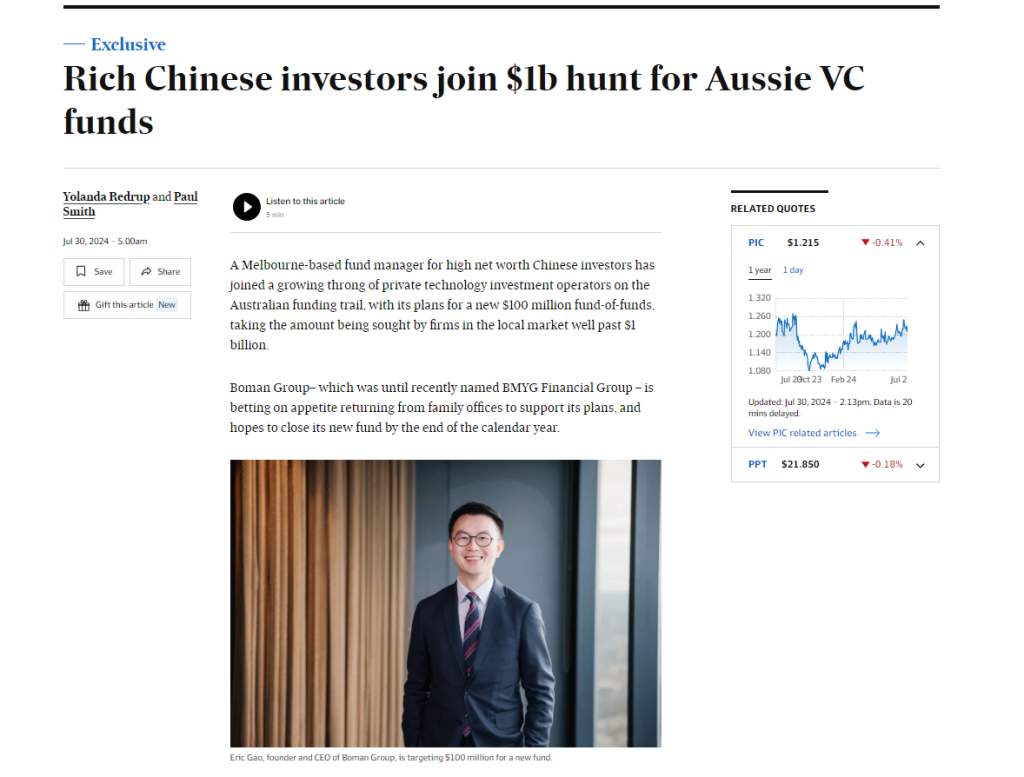

In an interview with the Australian Financial Review, Gao Songyu, Founder and CEO of Melbourne fund manager Boman Group, highlighted a generational shift in wealth values. He noted that compared to first-generation wealth creators, the next generation places greater emphasis on environmental concerns and is highly interested in technology—an outlook that aligns closely with Boman Group’s investment philosophy and direction.

“Many second-generation individuals have been educated in Australia and understand that they have access to global opportunities and emerging industries. This represents a highly attractive opportunity for Australia’s wealth management sector,” Gao stated.

Recognizing the transformative potential of intergenerational wealth transfer, Gao identified an evolving set of investment needs between the first and second generations. In response, Boman Group has launched two new business divisions: a Joint Family Office and a Capital Markets Advisory service.

The Joint Family Office aims to assist high-net-worth families in managing the complexities of wealth succession. Meanwhile, the Capital Markets Advisory division will provide capital solutions and strategic support to high-quality Asian businesses operating in Australia. This includes facilitating the international expansion of Chinese enterprises as well as guiding global capital into Chinese markets.

、

Seasoned Advisory Board Joins Boman Group

According to the Australian Financial Review, several respected figures from Australia’s wealth management and investment community have recently joined Boman Group’s Advisory Board.

The new members include:

Geoff Lloyd, former CEO of MLC Australia and Perpetual

Naseema Sparks, Director at Knight Frank Australia

Peter McGregor, former Executive Director of Infrastructure Investment at Goldman Sachs

Paul Chin, former Portfolio Manager at Vanguard and Barclays

The addition of this high-caliber Advisory Board brings significant expertise and prestige to Boman Group, reinforcing the Melbourne fund manager’s strategic capabilities as it moves into its next phase of growth.

Boman Group Founder and Advisory Committee

Boman Paradigm Fund Strategy Poised for Launch

In an interview with the Australian Financial Review, Gao Songyu, Founder and CEO of Melbourne fund manager Boman Group, revealed plans to launch a new private equity fund-of-funds with a target size of AUD 100 million.

“We’re seeing the door to the market gradually open. Launching this fund now is a strategic move to capture untapped investment opportunities in the venture capital space—especially at a time when fundraising environments remain challenging,” Gao stated.

The new fund will target sectors such as life sciences, productivity technologies, artificial intelligence, enterprise software, and renewable energy transition.

Boman Paradigm Fund, first launched in 2019, has successfully completed two prior phases. The fund has invested in several globally renowned private equity firms, including Square Peg, Main Sequence Ventures, Tiger Global, and Bain Capital.

Vincent Lu, Head of the Boman Paradigm Fund strategy, also shared insights with the Australian Financial Review. He noted that over the past two years, capital has shifted away from tech into more cash-generating, high-quality businesses. However, viewed through the lens of decades of capital market evolution, while cycles are inevitable, innovation never fades.

“We believe that innovation is essential to making the world a better place—this is a core principle we hold deeply,” said Lu. “As long as we believe in the permanence of innovation and entrust capital to the right investors, those funds will naturally flow to the right companies to realize that innovation.”

Vincent Lu, Head of the Boman Paradigm Fund strategy

“The high interest rate environment has led traditional venture capital limited partners to become more risk-averse,” said Gao Songyu. “We have a greater risk appetite, and thanks to our previous direct investments in startups, we possess deeper insights into tech businesses. We firmly believe that, given the current pace of innovation, the venture capital market—if positioned correctly—can leverage certain converging trends to make society better.”